On this website, you'll learn how to write a personal trading plan for trading and day trading, and how to trade more successfully in the stock market.

I will also show you my personal trading plan and explain how much money you can realistically make with trading.

A dream written down with a date becomes a goal.

A goal broken down into steps becomes a plan.

A plan, when acted on, makes dreams come true.

This somewhat romantic quote serves as an introduction to bringing us closer to the dream of financial freedom through successful day trading in the stock market. It won’t be as easy as it’s often sold, but it is possible. There is one very important thing to understand about trading:

Day trading is about probabilities. We can't control the market or the outcome of any single trade. We can only develop the best possible strategy and stick to it, and that's exactly what a trading plan does. With a trading plan, you increase your chances of being one of the winners. Without a trading plan, you're just gambling in the stock market.

Imagine calling the CEO of a company and asking how things are going and what the next steps are. You would expect any good CEO to at least roughly know new products, sales figures, company visions and goals, potential major expenses, and new customers, right?

When you trade in the stock market, you need start-up capital as an investment, you have fees, risks, and opportunities—just like any business. Every successful business needs a plan and someone to execute that plan.

However, many traders can't answer these types of questions for themselves. They start in the market and let the market dictate their actions. But that's not how a sustainable business works. If you want to be successful in trading in the long run, you need a trading plan, and I’ll help you create one on this website.

Note: Some prior knowledge, such as time frames, CFDs, FOREX, or what stocks and trading are, is assumed. If you're brand new to the stock market and don't know these terms, start with this excellent book about trading.

*Average customer rating on Amazon and other external review platforms

My name is Thomas Dahlmann, and I’ve been active in the stock market and trading for over 15 years. From my experiences, I’ve written two books that have become some of the most-read trading books in the German-speaking world, helping thousands of readers. "Day Trading for Beginners" helps with the perfect introduction to the stock market and stocks. For the specific psychological challenges of day trading, I wrote the book "Trading Psychology." I have personally coached many traders and analyzed a wide range of challenges and issues through countless emails from my readers. With this trading plan, I want to offer you another resource to help you find the best possible start in the exciting worlds of day trading and the stock market.

If you're still new to the stock market, these two books are the perfect starting point.

Since this is one of the most common questions I get, here is my broker recommendation for trading beginners. You'll find more questions and answers about the trading plan at the bottom of the page.

I took a short video tutorial for you, on how to open a trading account and install the free trading software Metatrader in less than 10 minutes.

A trading plan is like a business plan for a company. It contains all the important information about your day trading, such as strategy, trading hours, financial instruments, but also the equally important personal aspects like your motivation and personal goals.

Institutional traders often have plans provided for them. That’s why this page focuses on the needs of private traders, especially beginners in the stock market who start with little capital, so they can trade professionally and have a clear, structured approach.

I always recommend that every private trader creates a trading plan and strictly sticks to it!

Every trading plan is individual. Some people want to earn a little extra money on the side with as little time investment as possible, others just love trading, and still, others trade to make a living. Anything is possible, but each approach requires different strategies.

I won’t give you a complete trading plan on this page, but I will show you what to pay attention to. At the end of this page, you can download my personal trading plan template along with tips on how to tailor it to your situation.

The following reasons speak in favor of having a trading plan:

I will go into more detail on each point below, but to give you an overview, here’s a list of what you should definitely include in your trading plan:

Start by writing down your "why." Why do you want to become a trader? What do you hope to achieve? What rewards might you treat yourself to? During tough times, after losses or doubts, read your "why." As long as it still resonates, you’ll continue trading with discipline.

This point has always been very important to me when facing new challenges. When I started trading and doubled my trading account within a few days, but then lost everything just as quickly, I was close to giving up.

I doubted whether this could work and whether I was even cut out for it. The high from my first profits turned into a low.

I took a few days off and reconsidered why I should keep trying.

I realized that money alone wasn’t a good "why." My more meaningful reasons were the freedom it offered—location independence and the flexibility to control my time. I reminded myself of the opportunities and possibilities that trading provided and wrote it all down.

After every loss, every setback, every mistake, I read my own words, and it helped me overcome the doubts and gain the discipline I needed to keep going.

That's why your trading plan should always start with your "why." Your personal reasons and your personal motivation for why you want to start trading. Read these lines regularly, and they will help you stay the course during tough times.

The second important point in a trading plan is your goals. Goals are somewhat tied to the motivation we talked about earlier, but with the important distinction that goals should always be concrete and measurable.

We often talk about S.M.A.R.T. goals. The letters stand for Specific, Measurable, Achievable, Realistic, and Time-bound.

This means defining your goals as precisely as possible. The following six W-questions are commonly used in project management for this:

The last question ties back to your personal motivation from section 1.

It’s important that your goal is measurable. Here are some W-questions to help with this:

You should document your progress towards your goal in writing. (And remember to celebrate sometimes!)

You should accept your own goals and fully stand behind them. This means your goals should be reasonable, attractive, and challenging enough, but still achievable.

If your goal exceeds your abilities or time availability, you should set it a bit lower. These W-questions can help:

If you’ve never run before, you won’t be able to run a marathon overnight, even if that’s your goal.

Successful day trading is also a marathon, not a sprint, even though you can start trading in minutes. You should be aware that turning $100 into millions overnight is unrealistic. You can start the marathon now, but can you finish the 26 miles?

Unrealistic goals lead to frustration and a negative mindset like "I’ll never achieve this." That mindset will block your success.

So set a goal that you personally believe in and that seems realistic given your current situation.

At the end of this page, you’ll see what earnings are realistic with a solid day trading strategy.

Set a deadline. It doesn’t have to be when everything is achieved. Often it’s easier to break your goal into smaller steps and implement them bit by bit.

For example, in my early days, I spent the first month just practicing entries, then worked on better stop-losses, then added indicators, and so on. I made a conscious effort not to take on too much at once. Even today, after over 10 years in the market, I’m still learning, and it’s a daily practice.

Setting deadlines increases your awareness of the goal and gives it a certain seriousness. This, in turn, provides a powerful motivational boost. If you don’t have a timeline or deadline for your goals, they often fade into the background of your mind. Setting deadlines creates a healthy sense of urgency.

These questions can help:

Now that you know the most important aspects of setting successful goals, here are two examples to clarify:

Example of a concrete goal:

I want to earn $6,000 a month from day trading within 12 months, working 2 hours a day, because...

Example of a vague goal:

I want to make more money.

The first example serves as a good guide. The second is so vague that you could achieve it by collecting bottles for recycling.

Choose a financial product. Especially in the beginning, you should focus on just one. For beginners, I usually recommend CFDs (Contracts for Difference).

These are recommended for beginners because they are easy to use, simple to understand, and have low entry barriers.

Additionally, CFDs allow you to trade almost all markets successfully with most day trading brokers.

For example, you can trade CFDs on stocks, indices like the DAX, commodities, currencies, cryptocurrencies, or even food products. There’s hardly a market that doesn’t offer CFDs.

Decide which markets you will trade in. I recommend trading no more than 1-3 markets at the same time and, especially as a beginner, focusing on just one market.

A market could be the currency market with Forex trading. Here, you might focus on the majors or initially just one currency pair like EUR/USD. Other markets include various indices, commodity markets, stock markets, etc.

If you focus purely on technical analysis, it may be tempting to trade as many markets as possible because, in the end, they’re all just charts.

However, every market has its own characteristics, and sometimes less is more. It's better to make a few good trades than as many as possible. Otherwise, you’re just paying unnecessary fees and may end up seeing trading signals everywhere, even where there aren’t any.

Overtrading is one of the most common reasons traders lose money.

An important aspect, in addition to trading hours, is the time frames you use for chart analysis. In the book, I generally recommend all beginners start with H1, which is one hour. The holding period of each position then depends on market activity and the strategy.

The time frame you should choose depends on your personality and strategy. If you’ve chosen a scalping strategy, you’ll trade on the tick chart or M1. However, this can be very "nerve-wracking," as the M1 chart is highly volatile and can lead to many false signals. Additionally, the fees increase significantly because you trade more often. On the other hand, the risk for individual positions is automatically reduced due to tighter stop-loss limits.

Some traders handle this mentally better, while others have enough patience to wait a few days for their position to turn positive. This is a learning process that every trader must go through.

So, define in your trading plan which time frame you will trade in.

Note: This is the time frame for entries and exits. For chart analysis, it’s always helpful to look at multiple time frames.

This point is quite simple yet important. Set in advance how long you will trade each day, or how much time you’ll invest in trading overall.

The daily time commitment is divided into three phases:

Take time for all areas and set a reasonable maximum, especially for trading. Remember, day trading is scalable. You won’t earn more just because you trade more. No one pays you by the hour. With just one good trade a day, you can already earn a good income. Sometimes it’s even enough to trade just once a week. I have some strategies, like the crash strategy introduced in the book and course, that trade much less frequently and still generate very high profits.

Day trading offers a lot of freedom, but it also requires many decisions, like choosing your trading hours. Depending on how you answer this question for yourself, you might trade Forex, commodities, European stocks, U.S. stocks, or Asian markets.

The choice of trading hours also depends on the financial product you’ve chosen. The Forex market is open practically 24 hours a day, while stock market hours are roughly aligned with a regular workday. Of course, you also need to consider the specific market and its time zone.

Decide for yourself which trading hours you want to stick to.

Pay close attention to when stock market hours overlap.

During these times, larger market movements are often expected. For example, if you’re trading in the German market and the New York Stock Exchange opens in the afternoon.

In my sample trading plan, you’ll find all the market hours, overlaps, and other helpful information clearly laid out. These details are also widely available across various resources online.

Define the starting capital you want to use for your first steps. In theory, you can start with as little as $100 – $200, but a more reasonable amount is usually between $500 – $1,000. With a bit more starting capital, it’s easier to maintain proper risk management and implement good strategies.

You can also start risk-free with a demo account and try out trading first. You can create a free demo account here.

Very important note:

Only trade with capital you can afford to lose completely. Do not go into debt, and do not trade if you are in debt. The risk with leveraged products and day trading is very high.

Strategy is, of course, personal, and in the book or course, I already introduce various strategies. So I won’t go into strategy here. However, not having a strategy is one of the most expensive mistakes that (day) traders often make, costing them a lot of money!

It’s important that you document your strategy in your trading plan as clearly and in as much detail as possible.

Later, when new situations arise during trading, the market turns against you, or you’ve made losses or very high profits, these are highly emotional moments. (Even after more than 15 years in the market, I still feel this way, although the sums that get me emotional have certainly increased.)

The only thing that helps in these situations is if you’ve made a clear, rational decision beforehand about how to behave.

Will you let the position run even if you’re already far in the green? Will you close the position at a loss? Should I enter now, or wait? Is it still worth entering?

Such questions constantly arise in trading, and you often have to make quick decisions. This isn’t easy, but with a clear strategy, you make these decisions once and then simply implement them over time. In the long run, you can always optimize your strategy and maximize your profits.

Tip: In case of doubt, if you’re unsure about a situation, it’s better to skip the trade. There are always plenty of opportunities.

In practice, having a strategy—and sticking to it—is extremely important, even if you initially make losses! Only then is trading traceable, and you’ll have points for improvement.

For handling emotional situations and challenges in trading, I recommend the book Trading Psychology. In it, I share my personal experiences and how I deal with emotionally difficult situations.

Make sure to clearly define when you open a position, when you close it, and how you behave in special market situations. Trading without a strategy is just gambling.

This is, along with strategy, probably the most important part of your trading plan, and it’s crucial that you stick to it during trading.

Define your personal risk management.

Risk management means becoming aware of the risks involved in trading and doing your best to quantify and limit them. Risk is the probability of occurrence multiplied by the potential loss. You can’t change the probability, except by adjusting your strategy over time, but not within a single trade.

However, you can always limit the potential "loss."

Define what percentage of your capital you are willing to risk per trade, along with any other metrics that are important to you personally.

Document your risk management carefully as an essential part of your strategy.

Position size is closely related to risk management and refers, for example, to the number of CFD contracts you trade at one time.

It’s very important that in any strategy and market, you always choose a position size that aligns with your risk management and that you don’t change it during individual trades.

Changing the position size is one of the common mistakes beginners often make in the stock market!

For example, you could always trade 0.1 DAX contracts or 10 VW shares if that fits within your risk management.

Only when you have been profitable with a strategy over a longer period and multiple trades should you adjust your position size to your current risk capital.

Depending on the trading platform, besides position size, you can also adjust the quantity individually. For instance, in MetaTrader 4, you can have two open positions of 0.1 DAX contracts, while MetaTrader 5 and other platforms automatically combine these into 0.2 DAX contracts. This is just a difference in how it’s displayed, but in practice, the same rules apply.

Trading routines are actions you perform before or after every trade, like brushing your teeth daily—automatically, without thinking about it.

Some things, like keeping a trading journal, can be difficult for many people. But if you establish it as a fixed routine that you don’t have to think about, you will automatically become a better trader.

I have different routines that I follow before, during, and after trading. Many factors come into play here. On one hand, routines like filling out a trading journal make you a better trader, and on the other hand, routines help you manage the psychological challenges of day trading and handle the freedom that comes with it.

What happens if you raise your arms in the air like you’ve just won the biggest boxing match in history? Or like you’ve just scored the decisive goal for Germany in the World Cup final?

What happens if you stand in front of the mirror and start smiling, or even laughing out loud?

Try it out!

Our brain associates certain actions with certain feelings. In Neuro-Linguistic Programming (NLP), this technique is called "anchoring." Specific actions are linked to emotions.

I’ve developed routines that not only improve my trading but also boost my mindset before I start "working."

Examples of Trading Routines:

Before the trading day:

I try to get in the right state of mind by doing some exercises. I also read my personal motivation and goals.

Before a trade:

I analyze the chart in all time frames.

After a trade:

I write in my trading journal and take a screenshot of the trade so that I can review it later.

This is the last point in my trading plan.

I write down rules for myself that I follow.

You’ve already seen some of them in the book "Trading Code". These rules aren’t fixed, and I regularly add new ones and occasionally remove some, even after many years of trading.

For example, I noticed that around lunchtime, between 12 and 2 PM German time, the DAX and other stock markets tend to move sideways.

As a beginner, I wanted to trade all the time, so I kept trading during these hours. However, when I reviewed my trading journal, I saw that I mostly lost money during this time.

So, I made a rule not to trade during these hours. Since I’ve stuck to this rule, my overall trading results have improved.

I also had the problem that I would make many small profits, but in one or two situations where I felt particularly confident, I would increase the position size to try and make even more money.

But this didn’t always work out, and most of the time, I lost all my profits in those one or two trades.

Even if I won the trade, I found it hard to go back to trading with a smaller position size afterward because I had just made more money with a larger size. In the long run, my trading wasn’t profitable this way.

So, I added another rule: I always trade with a fixed position size in a given market and strategy. Once I stuck to this rule, my trading results improved again.

Over time, various rules developed, and eventually, my trading became profitable.

Write down rules in your trading plan that work for you. These will come from your personal strategy and from reviewing the results of your past trades. Identify when you tend to lose money and avoid those situations.

Read your rules before every trading day. Over and over again, until you’ve fully internalized them. Even then, it doesn’t hurt to keep reading them daily as part of your trading routine.

If you want a more detailed document where I present my personal trading plan and go in-depth on all the key points that helped me succeed in the stock market, you can secure my complete trading plan for your stock market success here.

This plan is perfect for beginners with a starting capital of at least $100-$500 who want to trade profitably with a simple strategy and minimal time commitment.

If you want to start with more/less capital, you can easily adjust the position sizes accordingly.

The trading plan includes:

This is one of the most common questions I receive. So, here's the warning upfront: Day trading is often not an easy path to quick wealth! It is risky! It requires discipline, knowledge, and a good plan.

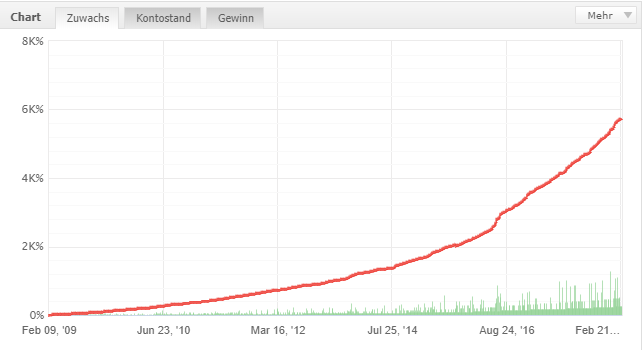

Below, I’ll show you the earnings from a trend-following strategy, like the one introduced in the trading plan, over a very long period of more than 10 years.

Some key figures:

Note: These figures do not guarantee that you will achieve the same profits or similar results. For all strategies, it’s important to remember: Past performance is no indicator of future results. In crises like 2008 or 2020, much higher profits can be made, while in sideways-moving markets, there are far fewer trading opportunities. I’ve chosen a very long period, including the last financial crisis, which also covers difficult market phases. This is a big advantage of day trading: you can also profit from falling prices.

Are you interested in taking the next step toward becoming a successful trader? Creating your own trading plan and trading more successfully in the future? Saving yourself time and nerves, and avoiding costly mistakes that I’ve made?

Then you can secure my personal trading plan below.

If you have any questions or feedback, feel free to send me an email.

The payment for the sample trading plan is processed through Digistore24, and you will immediately receive a download link via email after purchase, allowing you to download my trading plan. You can start implementing it right away.

Thanks to thousands of active readers, I’ve been able to constantly question and improve the trading plan, my content, and even my own trading. Below, I’ll directly answer some of the most common questions I receive.

Yes. I believe every trader, whether beginner or professional, should create a trading plan and follow it strictly.

That depends a bit on you and your trading. In general, you should reassess your goals and motivation at least once a year. You should adjust your trading rules or strategy when you can confidently say that the changes will improve your trading results. As a rough guide, I recommend making adjustments after at least 50 trades.

No. Many elements are the same; you simply add the additional strategy and evaluate those trades separately. However, I recommend that beginners start with just one strategy.

You can adopt the strategic considerations and structure of the template exactly as they are. The motivation and some aspects like trading hours should be tailored to your situation. I’m active in the market full-time and can trade whenever I want. These adjustments are easy to make and are explained separately.

I don’t know your goals and situation. However, if you send me specific information and questions related to the trading plan template, I’ll look into the matter with you.

There are no real prerequisites. You should have a starting capital of at least $100-$500 and a computer with internet access. You should also have a basic understanding of trading or be willing to do some research if anything is unclear. You can find many additional free resources on the Day Trading Academy website.

You can download it right after the payment and save it locally as a PDF file, which can be viewed with any PDF reader.